This assessment is important so that MyBrix can determine that the property owner can meet future buyback obligations, and the investor interests are looked after. More info here.

Create a proposal to list their application on the MyBrix Platform. This listing will have general information regarding the potential property the future owner is looking to purchase. More info here.

From the moment the listing gets created to the last Brix are purchased this is the funding stage. At this stage investors can see your property proposal on the MyBrix platform and purchase Brix in the property. More info here.

Once all Brix are purchased, the property owner finds a property and uses their own savings for the deposit. MyBrix manages the transaction, securing the balance and protecting investors with a first mortgage, while any leftover funds are transferred to the owner. More info here.

Disclaimer: This blog explains the process specific to Index Funding, which is designed for homeowners looking to finance the purchase of a new home through MyBrix. This process does not apply to refinancing existing properties.

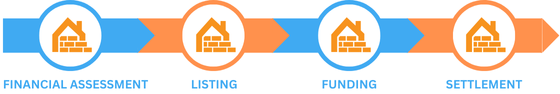

For property owners looking to purchase a new home, there are four stages to the funding process:

This blog describes the process of listing a property on MyBrix for Index Funding, with details on each stage of the process.

The first step in the Index Funding process is a Financial Assessment, here MyBrix evaluates property owner to see whether they will be able to afford to buy back the Brix from investors over time each month. This assessment is important so that MyBrix can determine that the property owner can meet future buyback obligations, and the investor interests are looked after.

During this stage, MyBrix works closely with the property owner to evaluate their financial standing and assess whether Index Funding is a suitable option.

If the property owner passes the financial passement MyBrix will work with them to create a proposal to list their application on the MyBrix Platform. This listing will have general information regarding the potential property the future owner is looking to purchase.

From the moment the listing gets created to the last Brix are purchased this is the funding stage. At this stage investors can see your property proposal on the MyBrix platform and purchase Brix in the property. Only when all Brix are purchased can the owner move onto the settlement phase. It is important to note that MyBrix maintains control of the fund’s they are not realised to the property owner at this stage.

Investors need to buy brix in lot’s of 12 for example an investor can purchase 12 brix, 24 brix 48 brix but not 30 Brix.

Settlement begins once all the Brix that were available are purchased by Investors. Once that happens the property owner start’s looking for the property, they wish to purchase knowing they have a deposit and the amount they required has been funded (note: at this point MyBrix still controls the funds and property owners cannot access the funds).

When the owner has decided on which property they would like to purchase they get the contracts checked by MyBrix’s convenors and if everything is clear they can go ahead and put a deposit on the property from there own savings, the funds raised through MyBrix can not be used as a deposit and the property owner must always have least 20% of equity in the property.

MyBrix will then manage the transaction between the funds raised by investors and the realtor to pay the remaining balance of the property and take out a first mortgage on the property to protect the interest of the investors.

Once they is complete any remaining funds that we’re not used to purchase the property gets transferred into the property owners account.

IMPORTANT INFORMATION

MyBrix does not provide any financial, Tax or other advice, you must obtain your own independent financial, legal and tax advice regarding the appropriateness of using any MyBrix Services, having regard to your personal objectives, financial situation and needs. You should not make any decision, financial, investment, trading or otherwise, based on any of the information presented in this blog, any and all information presented in this blog is provided for information only and any action you take as a result is at your own risk.

MyBrix is an innovative solution for property finance that breaks free from outdated traditions. Here are some typically questions. property owners have, see our Frequently Asked Questions (FAQ) page for more details.

MyBrix does not provide any financial or other advice, you must obtain your own independent financial, legal and tax advice regarding the appropriateness of using any MyBrix Services, having regard to your personal objectives, financial situation and needs.

Copyright © 2024 MyBrix. * Depending on the investment strategy deployed by the investor.