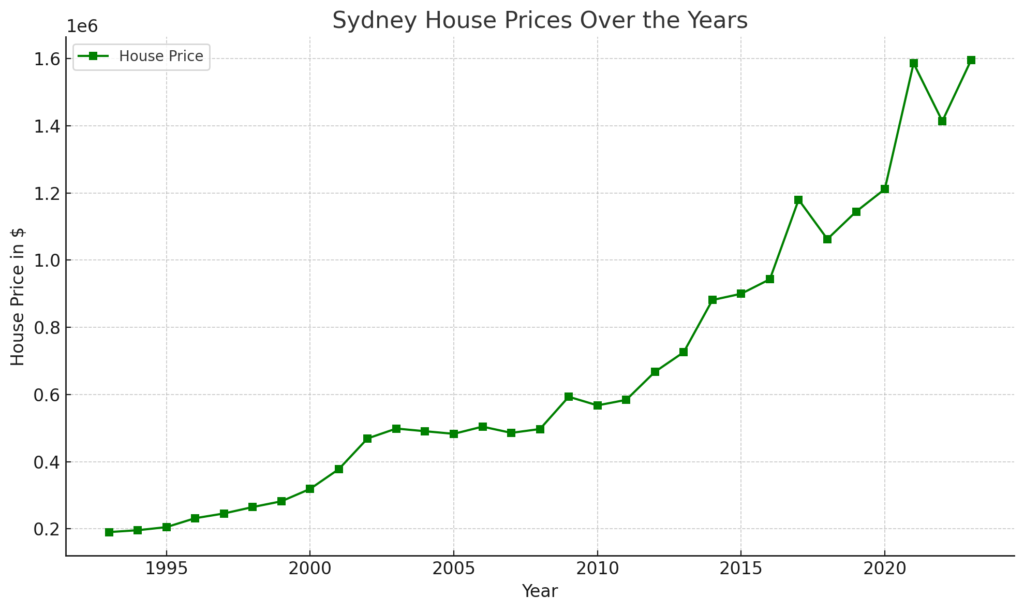

When the market is falling it’s easy to get scared and not want to buy after all no one wants to invest in a property only to see that they could have bought it cheaper if they waited 3 months. Market downturns are not uncommon in fact they are more common than you may think. Take a look at the chart below showing how Sydney’s property market has gone up and down over the years, It’s a bumpy ride but clearly as long as you hold you still end up on top. I don’t think investors who purchased before one of those dips really mind what they could of bought a little cheaper when you look at the bigger picture. MyBrix investors are one step ahead because with MyBrix you can mitigate the risks and headaches that come with a market downturn, but more on that later.

Zoom Out and Look at the Big Picture

One common misconception about property investment is that house prices only ever go up. That’s not exactly true. While Sydney’s property market has seen an average growth of around 7% per year over the last 30 years, that doesn’t mean every year is a winner. Sometimes prices fall, sometimes they soar well beyond that average. From 1993 to 2023, house prices in Sydney have had plenty of ups and downs, but the long-term trend is clear prices generally increase over time.

Take the period between 2004 and 2005, for example. The median house price in Sydney dropped from $490,531 to $482,798. But it wasn’t long before the market recovered, and by 2009, prices had climbed significantly. Fast forward to 2021, and the median price hit an all-time high of $1,586,171. What does this show? Short-term dips are part of the property cycle, but the overall direction is usually up.

Why MyBrix Makes Sense in a Market Dip

This is where MyBrix really stands out. In a market downturn, traditional property investment can seem overwhelming with all the upfront costs and ongoing expenses like maintenance and management. But MyBrix lets you skip all that by allowing you to invest in Brix in top-tier Australian properties with no acquisition or holding fees, so you’re positively geared right from the start. Through Equity and Index Funding, you can tap into long-term capital growth without the burden of full ownership, making it a smart move when the market feels a bit shaky.

The Market Dip’s Then the Market Rises!

Over the past 30 year the Australian property market has risen by an average of 7% per year, this is an average it doesn’t meant it goes up 7% every year! Some years it goes down others it goes up but when you look at the graph you can see that Sydney’s property market has always shown it can come out on top and that’s true for most of Australian real estate! Look at the examples in the graph like in 2008 when house prices dropped in many countries, Sydney managed to recover quickly. After a small dip from $485,648 to $497,106 between 2007 and 2008, the market bounced back and continued its steady climb.

Although it’s ideal to hold over those dips with the idea that the market will pick back up in the long term, this could be difficult. With expensive overheads, holding negatively geared property for years waiting for it to go back up is a lot harder than it is to sell at a loss. With MyBrix, you don’t need to stress about the market, by owning Brix, you’re cushioned during market drops as you have no holding costs to worry about, your also buying in at below market value allowing you to stay green even if the market was to drop a little and if you opted to buy Indexed Brix, you have a set index return which will be paid to you no matter what the market does!

Short Term Dip’s Arn’t So Bad

It’s understandable to feel hesitant about diving into the property market when prices are on a downward trend. But sitting on the sidelines during a market dip can mean missing out on future growth. Take Sydney’s market between 2022 and 2023, for example—house prices shot up from $1,413,658 to $1,595,310 in just a year after a period of decline. That’s a pretty big jump! Investors who stuck it out through the downturn are probably glad they didn’t sell in a panic.

With MyBrix, you can take advantage of these dips without the financial strain of full property ownership. By investing in Equity or Index Funding, you’re buying in at a lower cost, and as the market recovers, your Brix benefit from the growth. MyBrix allows you to diversify your portfolio across multiple properties, reducing risk and increasing your potential for returns when the market rebounds.

The Myth of a Housing Market Crash

There’s always chatter about a potential crash when property prices drop, but historically, Sydney hasn’t experienced any long-term crashes and the same thing can be said for the wider Australian property market. Yes, there are declines, but they’ve never lasted. Between in Sydney 2017 and 2018, for example, prices fell from $1,180,024 to $1,062,619, only to rise again the following year to $1,144,500.

The idea that a dip in the market is a sign of doom is a myth. History shows us that property values generally recover—and then some. It’s about weathering the storm. When prices fall, it’s usually an opportunity in disguise or even better if you Invested in Brix there is no storm to worry about!

Why Now Might Be a Good Time to Invest

Would you rather at the top of the market or buy when the market is about to head back up? The truth is you can never time the market, but you can’t beat time in the market so when you do see a market downturn, it could be a perfect buying opportunity. When prices drop it means your buying in at a lower cost leaving you with more savings and a better path to future gains. Warren Buffet once famously quotes “Be fearful when others are greedy, and greedy when others are fearful,” so if you see the property market doing down, you see other investors selling up and running that’s when its best to be greedy and buy!

With MyBrix, you’re not just investing in property—you’re investing in a smart, forward-thinking solution that reduces the risks associated with full ownership. The property market can have its ups and downs, but with MyBrix, you’re investing in a way that takes away the stress. You don’t have to worry about the usual costs like maintenance or mortgage repayments, and because you’re buying in at a discount or getting fixed, indexed returns, your investment stays secure even if the market continues to dip. It’s a smart way to invest, knowing that your returns aren’t tied to short-term market swings.

IMPORTANT INFORMATION

MyBrix does not provide any financial, Tax or other advice, you must obtain your own independent financial, legal and tax advice regarding the appropriateness of using any MyBrix Services, having regard to your personal objectives, financial situation and needs. You should not make any decision, financial, investment, trading or otherwise, based on any of the information presented in this blog, any and all information presented in this blog is provided for information only and any action you take as a result is at your own risk.

MyBrix is an innovative solution for property finance that breaks free from outdated traditions. Here are some typically questions. property owners have, see our Frequently Asked Questions (FAQ) page for more details.

MyBrix does not provide any financial or other advice, you must obtain your own independent financial, legal and tax advice regarding the appropriateness of using any MyBrix Services, having regard to your personal objectives, financial situation and needs.

Copyright © 2024 MyBrix. * Depending on the investment strategy deployed by the investor.