The initial assessment is an automated process, with the outcome delivered to the property owner via email, along with a full Product Disclosure Statement (PDS). More info here.

The property application includes KYC/AML checks for all titleholders, a manual property valuation, and review of the Product Disclosure Statement (PDS). Property owners must seek independent legal advice and provide a solicitor’s certificate to MyBrix as part of the application process. More info here.

From the moment the listing gets created to the last Brix are purchased this is the funding stage. At this stage investors can see your property on the MyBrix platform and purchase Brix in the property. More info here.

Property settlement is the final step, where mortgage documents are signed, and a licensed conveyancer coordinates with all parties, including the outgoing bank. Once all details are completed, the current mortgage is discharged, and the MyBrix mortgage is established for Brix holders' security. More info here.

Disclaimer: This blog explains the process specific to Equity and Release Funding and is only applicable to homeowners looking to refinance existing properties, not to those purchasing new properties. If you’re looking to purchase a new property, please refer to the Index Funding or Social Funding processes

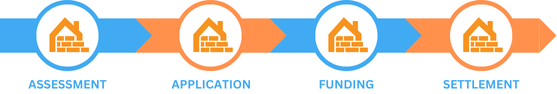

For property owners, there are four stages to the funding process:

This blog describes the process of listing a property on MyBrix, with details on each stage of the process.

This blog describes the process of listing a property on MyBrix, with details on each stage of the process.

The initial assessment is an automated process, with the outcome delivered to the property owner via email, along with a full Product Disclosure Statement (PDS). The property owner reviews the assessment report to decide if they want to make an application to list on MyBrix.

The property assessment report includes the Investment Attractiveness Rating (IAR), which is a score out of 1000 to provide guidance to investors on the potential return on investment possible from the property. The assessment report also includes the estimated market value range of the property (based on data available) and the potential funding range. At this stage, no guarantee of funding is made.

All estimated values in the Assessment Report are generated:

Any estimated values are current only at the date of publication or supply, and MyBrix can’t guarantee that an estimated value is an accurate representation of the market value of the property. If you are not satisfied with the estimates provided in the automated Assessment Report, you can request a more detailed manual assessment by a licensed valuer, and a manual report will be compiled. Please note this option will have additional fees and charges, and there are NO REFUNDS for either the automated or manual assessments.

The Disclaimer (sorry, we have to have one):

The information provided in the report is of a general nature and should not be construed as specific advice or relied upon in lieu of appropriate professional advice. While MyBrix uses commercially reasonable efforts to ensure the data provided is current, MyBrix does not warrant the accuracy, currency, or completeness of the Report and, to the full extent permitted by law, excludes all loss or damage howsoever arising (including through negligence) in connection with the report, which is compiled from other third parties for presentation to you by MyBrix.

The property application includes Know Your Customer (KYC)—full identification of the applicant—and Anti-Money Laundering and Counter-Terrorism (AML) compliance checks. All people listed on the property title must undergo KYC/AML checks.

In addition, it is important that you read the Product Disclosure Statement (PDS) and acknowledge that you have read and understood the PDS.

As part of the application process, a detailed manual valuation of the property is undertaken by an independent licensed valuer (this takes approximately 2 to 4 weeks), with a full report sent to the property owner.

The valuation report is sent to the property owner for consideration, along with the market valuation and the maximum funding possible under MyBrix. At this stage, no guarantee of funding is made.

Pro-forma mortgage documents are also provided at this stage.

All parties listed on the property deed need to seek independent legal advice regarding the product and the associated documentation provided by MyBrix. It is a MyBrix requirement that a solicitor’s certificate is obtained and provided by the property owner to MyBrix, acknowledging they have sought independent legal advice.

Once the application process is complete and the amount of funding to be secured from investors is agreed upon, the property will be listed to undertake an Initial Brix Offer (IBO).

An IBO is where investors are informed about the property on offer, how many Brix and the type of Brix on offer, as well as the price of the Brix. The high-level details of the property, the Property Assessment Report, and the valuer’s report will also be available for investors to review. Specific address details are not disclosed, only the street name, suburb, and state.

Once the IBO is fully subscribed, funding is guaranteed, and the property can move to the settlement stage.

Property settlement is the final step in the process. The mortgage documents are signed, and a licensed conveyancer will finalise all the details with your outgoing bank and you as the property owner.

In this part of the process, there are typically a number of parties involved to ensure that no minor details are overlooked and that all monies are accounted for during the final transaction.

Once all items are completed by all parties, the conveyancer will book the settlement, discharge your current mortgage, and establish the MyBrix mortgage as security for all Brix holders.

IMPORTANT INFORMATION

MyBrix does not provide any financial, Tax or other advice, you must obtain your own independent financial, legal and tax advice regarding the appropriateness of using any MyBrix Services, having regard to your personal objectives, financial situation and needs. You should not make any decision, financial, investment, trading or otherwise, based on any of the information presented in this blog, any and all information presented in this blog is provided for information only and any action you take as a result is at your own risk.

MyBrix is an innovative solution for property finance that breaks free from outdated traditions. Here are some typically questions. property owners have, see our Frequently Asked Questions (FAQ) page for more details.

MyBrix does not provide any financial or other advice, you must obtain your own independent financial, legal and tax advice regarding the appropriateness of using any MyBrix Services, having regard to your personal objectives, financial situation and needs.

Copyright © 2024 MyBrix. * Depending on the investment strategy deployed by the investor.